On social media, people are up in arms with how the government is quick to take care of the filthy wealthy bankers and don’t care at all about the working-class folk. “Oh, so the government can inject $1.5 Trillion in an instant to save the banks but can’t provide free healthcare to the 99 percent or free college education to its citizens. DISGUSTING!”

These types of comments show a lack of understanding of financial markets and are simply wrong. The Fed injection is an effort to make sure the bank or financial institution where your money is deposited is there when you want it. It is not merely to make sure the wolves of Wall Street don’t go hungry—it’s to make sure you don’t go hungry.

The Fed

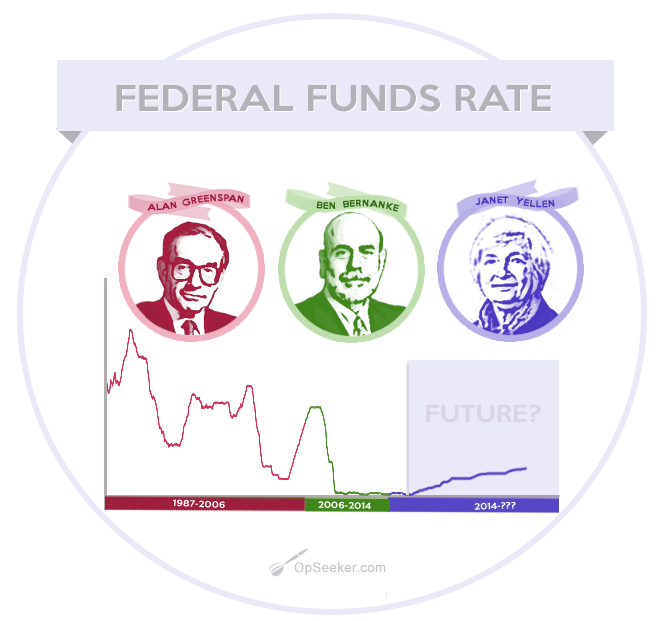

The Federal Reserve or the “Fed” is the central bank of the United States. This entity is purposely separated from the government to avoid political influence. The Fed is a bank. And, like any bank, it does not give money to any firm or individual. It is the mediator between borrowers and savers, of which are banks or the U.S. government.

The three primary functions of the Fed are:

- To control the price level by adjusting the money supply via monetary policy.

- To make sure we can all pay each other efficiently and effectively.

- To make sure banks are doing crazy things via regulation.

When we see headlines of the Fed “injecting” money into the financial system or “Wall Street,” they are not giving money to Wall Street. The Fed has bought short-term Treasury bills, which are government bonds or IOUs, from banks. The banks then use this money to loan out at lower interest rates (because the supply of money has just increased). The lower interest rates are supposed to incentivize borrowing, which keeps businesses and individuals investing in productive stuff.

The intended outcome of this “$1.5 Trillion Fed Injection” is that you, the 99 percent, get to keep your job.

The Fed vs. The Government

Monetary policy refers to the actions taken by the Fed. Fiscal policy, however, applies to actions taken by the government. We can shout, “Disgusting! Unbelievable! I…I, just CAN’T,” when the government starts to enact fiscal policy by injecting cash into their preferred industries. We can then wonder why that money isn’t going toward healthcare, education, paid-leave, daycare, farms, ice cream shops, toilet paper, or any other industry to which you believe we are righteously entitled.

In 2009, the government and the Fed engaged in policies to help the economy facing a downward spiral. The Fed aimed to battle the contracting economy by buying government securities, or bonds, to increase the money supply. But, when that expansionary monetary policy proved not to be enough, the government injected cash, in the form of fiscal policy, into the banks with the Troubled Assets Relief Program (TARP).

Both organizations were trying to help the average American citizen, and both were trying to do the right thing. There is a difference, though.

The Fed is a nonprofit organization, but makes a profit as any other bank does, buy paying savers lower than they charge borrowers. Notice how, when you save your money at the bank, the interest rate is lower than when you go to the bank to borrow the money? That difference is the profit, which goes toward operational expenses and then back to the Treasury Department, since the Fed doesn’t keep any of its earnings, and used toward government expenditures and reducing the federal debt.

Outside of the excess profit from the Fed, governments do not make a profit. They don’t “produce” anything. The government’s money comes from taxpayers. When the government buys or provides anything to individuals, firms, or industries, it must obtain those funds from taxpayers. Given that it’s hard to take the money from you at once without guns coming out, they’ll borrow it from future taxpayers–the older you, your children, and your children’s children.

Takeaway

So, no. The government isn’t giving money to anyone with the $1.5 Trillion injection from the Fed. Rest assured, the government will engage in fiscal policy pretty soon. For example, the payroll tax suspension proposed by the president could dwarf the fiscal measures taken in 2009. Billions of dollars will be spent to combat COVID-19 and the subsequent economic implications. Some of these expenditures will help! But, some will be a complete waste of money and maybe perpetuate the problem. And, given it’s an election year, you can bet your money on the government taking drastic measures in the attempt to make sure we are all fat and happy. Time will tell.

This stuff is complicated, even for economists. There is enough ignorant hysteria with the pandemic. Adding an extra dose of ignorant hysteria will certainly not help the situation.